Identity and Anti Money Laundering Regulations

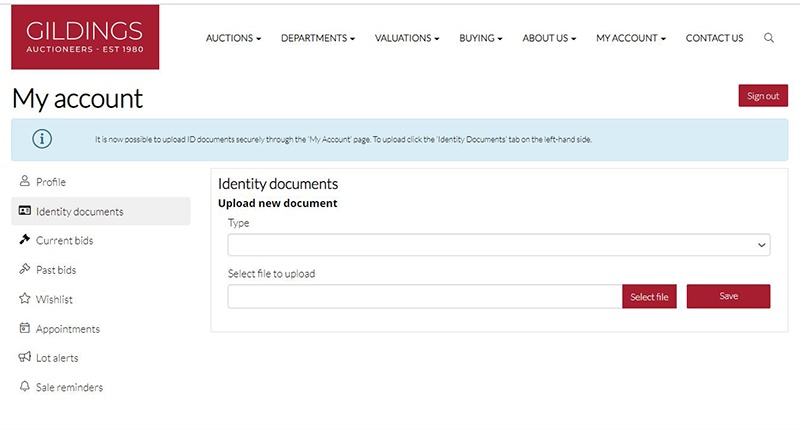

From 10 January 2020, art market participants such as Gildings Auctioneers, who deal in sales, purchases and/or storage of "works of art" with a value of 10,000 euros or more, will be subject to further anti money-laundering obligations, under the Money Laundering Regulations 2017. These are issued by HMRC and are part of an international effort to tackle anti money laundering globally. As part of these obligations, we have to satisfy ourselves with the identity of our clients, be they vendors or buyers. For that reason, we are asking for all clients to provide proof of identity prior to selling or purchasing items with Gildings Auctioneers. We answer some questions that may stem from this throughout this page - Click to expand each question.